Clean beauty is the new green beauty. The natural product market is stronger than ever, but the landscape of product formulation and marketing is shifting. The most successful product segments are moving away from established certifications and focusing more on safe, clean, and effective formulas.

Natural skincare brands are growing at twice the rate of total skincare, and that growth is expected to continue, but the definition of natural has evolved as quickly as shoppers have gravitated towards it.

According to WWD, 2016 was a peak year for purchasing and using cosmetics. As a response to product overuse and the downside of all of that makeup application, 2017 and 2018 were about skincare. Now, the skincare consumer has her regimen, and fewer products come with a sense of newness and drive that impulse to click ‘buy.’

This is where the natural market comes in, as shoppers are trying to “clean up” their bathrooms and top shelves. They are on the hunt for clean “dupes” that give them the results that they know and love from their conventional products, but without the potentially harmful additives that could compromise their overall health and safety. The data supports this, as NPD reports that natural skincare accounted for $1.6 billion of total 2018 sales, up 23% from the prior years.¹

dupe [d(y)o͞op] / adjective 1. short for duplicate, used to describe a similar product that satisfies additional claims.

The larger dilemma that brands must solve for future development is multi-fold: how do they interpret natural claims? What will drive their brand’s success? Where are the biggest opportunities in the skincare space, especially with threats of a looming recession?

Why Natural?

First, we must understand why consumers are so interested in natural claims. Essentially, consumers are scared of the dangers of chemicals. The NPD Group reports that 90% of consumers believe that natural or naturally derived beauty ingredients are better for them.²

This ties in to the growing awareness that the US Government is not actively reviewing and banning potentially harmful ingredients from personal care products, and it is up to brands, contract manufacturers like Twincraft, and retailers to educate and protect the public from potentially harmful products. The European Union has banned 1,300 ingredients from personal care product formulations; conversely, the US has only banned 30.²

Since every single material used in personal care products is, in essence, a chemical, brands must work to combat large-scale fearmongering and focus on ingredient education and determine their own values and rules for safe product consumption.

The desire for natural products also ties in to the growth of the overall wellness market. The global wellness market grew 12.8% from 2015 to 2017, making it a $4.2 trillion industry.³ The concept of wellness captures interest in specific foods, exercise, supplements, home décor trends, vacation destinations, and much more. The larger trend that we are seeing is that it is aspirational to invest in physical and mental health and wellbeing in a way that it has never been before. Shoppers want to buy products that make them feel healthier and like they are investing in their overall wellbeing, and looking for natural labels is an easy way to accomplish this goal.

The desire for natural products also ties in to the growth of the overall wellness market. The global wellness market grew 12.8% from 2015 to 2017, making it a $4.2 trillion industry.³ The concept of wellness captures interest in specific foods, exercise, supplements, home décor trends, vacation destinations, and much more. The larger trend that we are seeing is that it is aspirational to invest in physical and mental health and wellbeing in a way that it has never been before. Shoppers want to buy products that make them feel healthier and like they are investing in their overall wellbeing, and looking for natural labels is an easy way to accomplish this goal.

Skincare is at the epicenter of the natural movement. We’re seeing some interest in natural makeup alternatives, with a lot of movement around sustainable packaging options. Over half of consumers look for makeup products made from natural ingredients, but only with only a 5% increase in dollar performance. Skincare is experiencing growth of 27%, and natural skincare brands brought in over 76% of skincare dollar gains.⁴

Divvying Up the Natural Market

With all of the opportunity and growth in the natural skincare space, it hasn’t taken long for brands to glom on to such profitable and unregulated terminology. The space is now littered with natural options at every price point, featuring “made with” and “free from” claims that are intended to attract buyers, but can also be very confusing for those who aren’t well versed in reading INCIs.

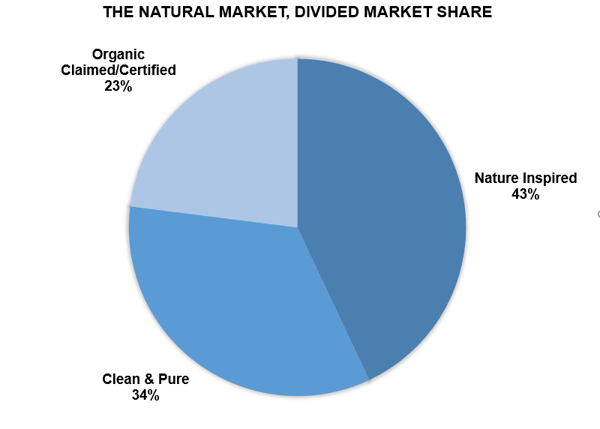

To help clarify different levels of natural and to put some structure around how industry players are interpreting natural claims, The NPD Group has established three buckets to classify natural skincare brands.

- Nature Inspired: Brands that formulate with natural ingredients and traditional synthetics. These are often conventional formulations with silicones, ethoxylates, and other ingredients that fall outside of the traditional natural space, but with featured nature-inspired ingredients, such as essential oils, “made with” claims or plant-based marketing stories.

- Clean & Pure: Brands that formulate with safe synthetics and combine them with natural ingredient stories. These brands are focused on efficacy and market “free-from” claims, ensuring customers that they don’t have to sacrifice safety for skincare products that actually work.

- Organic Claimed/Certified: Brands that contain organic ingredients with or without certifications through the USDA or other certification bodies, such as Oregon Tilth.⁵

Source: The NPD Group

Source: The NPD Group

While Nature Inspired is currently the largest segment, it’s the Clean & Pure category that promises the most growth and opportunity, which is also why the market has seen so many rising brands in the indie, prestige and masstige spaces that fall under this category.

Natural Claims in the Mass Space

The mass space is also seeing a strong rise in consumer interest in natural personal care products. According to Mintel, 52% of personal care shoppers 18 and older purchase a mix of mainstream and natural and organic brands. Only 1% only buy natural and organic brands.⁶ Traditional buyers are driven by price and function over secondary concerns, such as where the ingredients came from, which is a challenge for mass brands, but there is still plenty of room for growth and development within the Nature Inspired space.

In the mass market, shoppers are looking for natural options at mass merchandisers, such as Target and Walmart, and on Amazon, where they’re looking for identifiable ingredients and sustainable packaging (which is a great driver for new bar soap development) from brands that they already know and trust.⁷

Natural Indicators

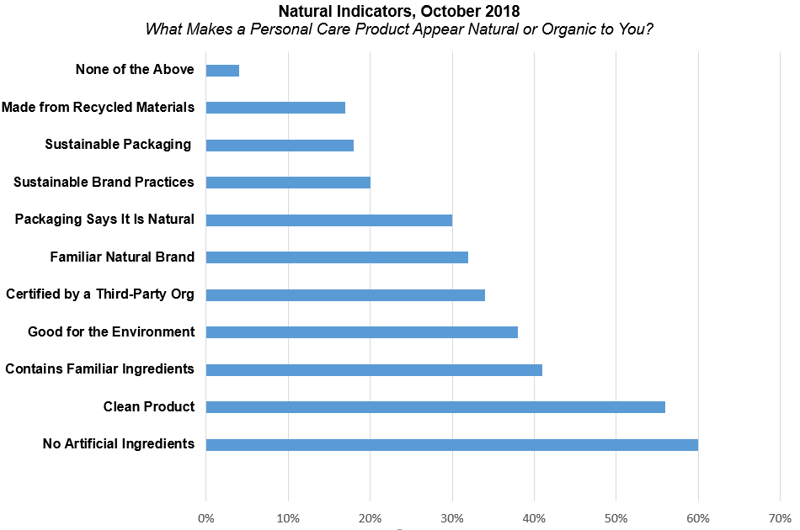

What exactly are shoppers looking for when they’re shopping for natural or organic skincare products? Mintel breaks it down with shoppers 18 and older who purchase natural or organic personal care products:

Source: Lightspeed/Mintel

Source: Lightspeed/Mintel

At Twincraft Skincare, we work with brands all along this natural spectrum, from Nature Inspired to Certified Organic, but we focus our internal developments and the efforts of our Innovation Team on products that will provide the most value to our customers. We’ve prioritized natural formulations free from silicones, parabens, PEGs, and sulfates long before it was trendy to so, which means that we have years of experience to support this new movement towards an interpretation of natural for all brands.

To learn more about how we can support your brand’s natural product development process, please reach out to our Sales team.

Sources: ¹WWD: Skin Care, Brick-and-Mortar Drive 2018 Beauty Sales | ²,³,⁴,⁵The NPD Group: Defining Natural Beauty, November 2018 | ⁶,⁷Mintel: Natural and Organic Personal Care Consumer, US, December 2018